The best store credit cards

Store credit cards have been around for a long time. If your spending habits favor one store over others, a store-branded credit card may be the right solution for you.

Store-branded credit cards are easier to get approved for, even without excellent credit, but they often come with high annual percentage rates. Over the years, many store credit cards have improved, offering better rewards to cardholders and more versatility for everyday spending.

We explore the best store credit cards, how they work and when adding one to your existing card lineup makes sense.

Best store credit cards

The information for the Target RedCard, Capital One Walmart card, and My Best Buy Visa card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

What is a store credit card?

There are two types of store credit cards: closed-loop and open-loop.

Closed-loop cards can only be used at the brand that issues them, such as Target or Best Buy. Open-loop cards can be used anywhere and are associated with merchant networks such as Visa and Mastercard.

Retailers can offer one or both types of store credit cards. For example, Best Buy offers two credit cards issued by Citi: My Best Buy® Credit Card and My Best Buy Visa® Card.

The former can only be used for Best Buy purchases, while the latter is a Visa card that can be used outside of Best Buy to earn rewards.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

The information for the My Best Buy credit card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

If you’re unsure whether a card is a store or store-cobranded credit card, look out for the Visa or Mastercard logo. This is a clear indication of the card being a cobranded store card.

Related: What’s the difference between a credit card network and an issuer?

How do store credit cards work?

Store credit cards work differently than regular credit cards. If the card is not a Visa, Mastercard or American Express, it will only work at a specific merchant or its associated retailers.

Also, store credit cards generally offer store-specific perks, favorable terms and payment options, making them popular with consumers who are loyal to a specific store or brand.

For example, the Target RedCard gives cardholders a 5% discount on purchases at Target or Target.com. The savings can quickly add up if you are a loyal Target shopper.

Store credit cards can even provide flexible financing options. This can be a great way to defer interest charges on large purchases such as electronics, living room sets or home remodeling jobs.

Related: Target Circle: Everything you need to know about Target’s revamped cards and loyalty program

Pros and cons of store credit cards

The pros and cons of store credit cards can vary depending on the card you select, but here are some things to look out for:

Pros

- Special discounts and offers: Store credit cards can give cardholders exclusive deals at specific stores, including discounts on purchases, free shipping or early access to newly released products.

- Rewards for store purchases: Store credit cards can offer rewards such as cash back, points or other incentives that can be redeemed for future purchases.

- Easier approval: Generally, store credit cards have more relaxed approval criteria than traditional ones.

Cons

- High interest rates: Store credit cards often charge higher APRs than regular credit cards.

- Low credit limit: Many store credit cards offer lower average credit limits than traditional ones. This could limit you if you want to make one or more large purchases.

- Potential to overspend: Generous offers such as deferred interest, discounts or other rewards could tempt you to overspend.

How to choose a store credit card

It seems like almost every major retailer has its own credit card and offers it to customers as soon as they check out at the register or online.

Here are some things to remember when choosing a store credit card:

- Do your research: Do not feel pressured to apply for a store credit card at the checkout counter. Compare the benefits and downsides of different store credit cards and read the fine print.

- Differentiate between open- and closed-loop cards: If you’re looking for a store credit card with benefits at a particular retailer, select a closed-loop card. If you want broader rewards on everyday spending, go with the open-loop card.

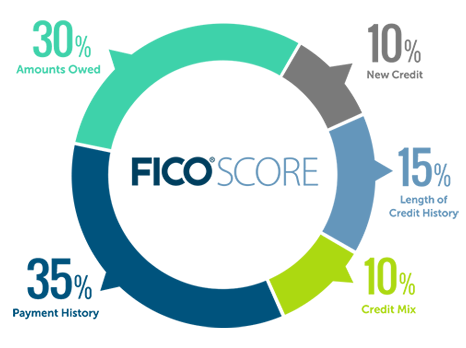

- Understand your credit: Take the time to determine if opening a store credit card is worth it from a credit score standpoint. Consider factors such as Chase’s 5/24 rule and whether the store credit card is worth occupying a space in your wallet.

Related: The best ways to use your Chase 5/24 slots

Benefits of store credit cards

When used properly, store credit cards can help you save money through discounts or deferred interest plans. These plans let you pay off your purchases within a set time frame without accruing interest.

Several years ago, I opened a My Best Buy Visa® Card to make a large purchase for a home entertainment system. At the time, the closed-loop card offered 24 months of deferred interest, which made it worthwhile.

While many balance transfer credit cards have 0% promotional offers, 24 months is hard to beat.

Maximizing store credit cards

Whether your store credit card is closed- or open-loop will determine how best to maximize it. Both card types are best used at their respective retailers for the best discounts, cash back or payment plans.

Open-looped cards offer value through the retailer and on everyday purchases. The Costco Anywhere Visa® Card offers 4% cash back on gas and electric vehicle charging (on the first $7,000), 3% on restaurants and travel and 2% on all other purchases from Costco.

You can redeem your cash back for a statement credit or Costco merchandise. If you shop at Costco frequently, the redemption options are a great way to offset future purchases.

Frequently asked questions

Here are some answers to common questions about store credit cards.

What store credit cards are easy to get?

Based on personal experience and data points from the internet, My Best Buy Visa and the Target RedCard are easier cards to get for those with mid-tier credit scores.

Do store credit cards help you build credit?

Yes. Store credit cards require a Social Security number to apply, are issued by banks such as Citi or TD Bank and are reflected on your credit profile.

If you maintain a low credit utilization ratio and make timely payments, it will be reported to the credit bureau and help build your credit.

Related: Things to do to improve your credit score

Are store credit cards worth it?

If you shop frequently at a particular store, the perks and discounts could be worth it in the long run. However, if you’re overspending on a store credit card, continuously carrying a balance and accruing interest, the cons outweigh the benefits.

Why do stores have credit cards?

Retailers sell goods and services, so they want to make it easy for you to spend. One way to do that is to offer a store credit card. By extending credit, they aim to increase your spending.

Can you use retail credit cards anywhere?

If you have an open-loop store credit card like the Costco Anywhere Visa, then yes, you can use the card anywhere Visa cards are accepted.

However, if you have a closed-loop card, you can only use it in person or online at the associated retailer. The absence of an issuer logo (e.g., Visa, Mastercard, American Express, etc.) indicates that you’re using a closed-loop store credit card.

Bottom line

Store credit cards have value, but you need to choose a card that matches your spending habits. If you’re only going to shop at a store a handful of times, getting a store credit card is probably not worth it.

Before you apply, check your wallet to see if your existing credit cards provide sufficient value.

Related: Credit cards that can get you $1,000 or more in first-year value