The best credit cards for your Disney vacation

Let’s face it: Disney vacations can be very expensive. There’s no pixie dust to magically make the costs cheaper.

However, there are strategies you can use to save money and earn extra rewards from your trip.

Whether traveling solo as a Lost Boy or vacationing with the entire Familia Madrigal, using the right credit card can take some of the sting out of constantly rising costs associated with a trip to the most magical place on earth.

Here’s a look at the best credit cards for Disney trips.

Best Disney credit cards

Chase and Disney have two cobranded credit cards. However, these cards earn Disney dollars, which limits redemption flexibility.

With the Chase Disney credit cards, you can earn and redeem Disney Rewards Dollars for on-property hotels, park tickets and on-property meals. Those are important (and pricey) elements of your Disney trip.

The Disney® Visa® Card has no annual fee and earns 1% in Disney Rewards dollars on all purchases. It also currently comes with a welcome offer of $200 statement credit after spending $500 within the first three months of account opening.

The Disney® Premier Visa® Card has a $49 annual fee and is the better option for most families because it offers broader earning and redemption categories. It earns 5% in Disney Rewards Dollars on card purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com, 2% on purchases at gas stations, grocery stores, restaurants and most Disney U.S. locations and 1% on all your other purchases. It also comes with a welcome offer of a $400 statement credit after spending $1,000 within the first three months of account opening.

The best Disney credit card will vary from person to person. And the answer may not be a “Disney credit card” at all. For most people, earning a mix of points from various credit cards will be most beneficial due to the flexibility this strategy offers. There are much better options than these cobranded Disney cards you could use for your next trip to Disney, which would help you maximize your earnings.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Related: Are the Disney Visa credit cards worth it?

Other best credit cards for Disney

There are multiple elements involved in your trip. Here’s an overview of the best cards for Disney, depending on which expenses you’re looking at:

*The information for these cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Best credit cards for using points on Disney hotels

The Disney Premier Visa and Disney Visa allow you to redeem Rewards Dollars for Disney hotels and resorts. One Rewards Dollar is worth $1 toward your bill. If you don’t have these cards, additional methods exist to pay for Disney hotels with points.

The Swan, Dolphin and Swan Reserve are on Disney property at Disney World and include many Disney perks. Since they are part of the Marriott family, you can use your Marriott Bonvoy points and free night certificates to stay on Disney property.

How many points you need for a night at these Marriott hotels varies, starting at around 40,000 points per night. This makes the Marriott Bonvoy Boundless Credit Card and Marriott Bonvoy Brilliant American Express Card great credit card choices for booking on-site lodging with hotel points.

Near Disney World and Disneyland, you also can enjoy a handful of Disney benefits at some off-property hotels. These open the possibility of using Hilton Honors, Wyndham Rewards and IHG One Rewards points for your hotel stay while enjoying benefits like early access and complimentary shuttles to parks.

If you want to use your hotel points and aren’t worried about these extra benefits, there are quality options near Walt Disney World and Disneyland from not just those programs but also World of Hyatt and Marriott Bonvoy.

Redeeming points for free hotel nights can significantly reduce the costs of a Disney vacation. A big sign-up bonus from credit cards in these programs could help you snag several nights at a hotel near Disney using points rather than cash.

Beyond the hotel programs, credit card points also can help you pay for Disney hotels.

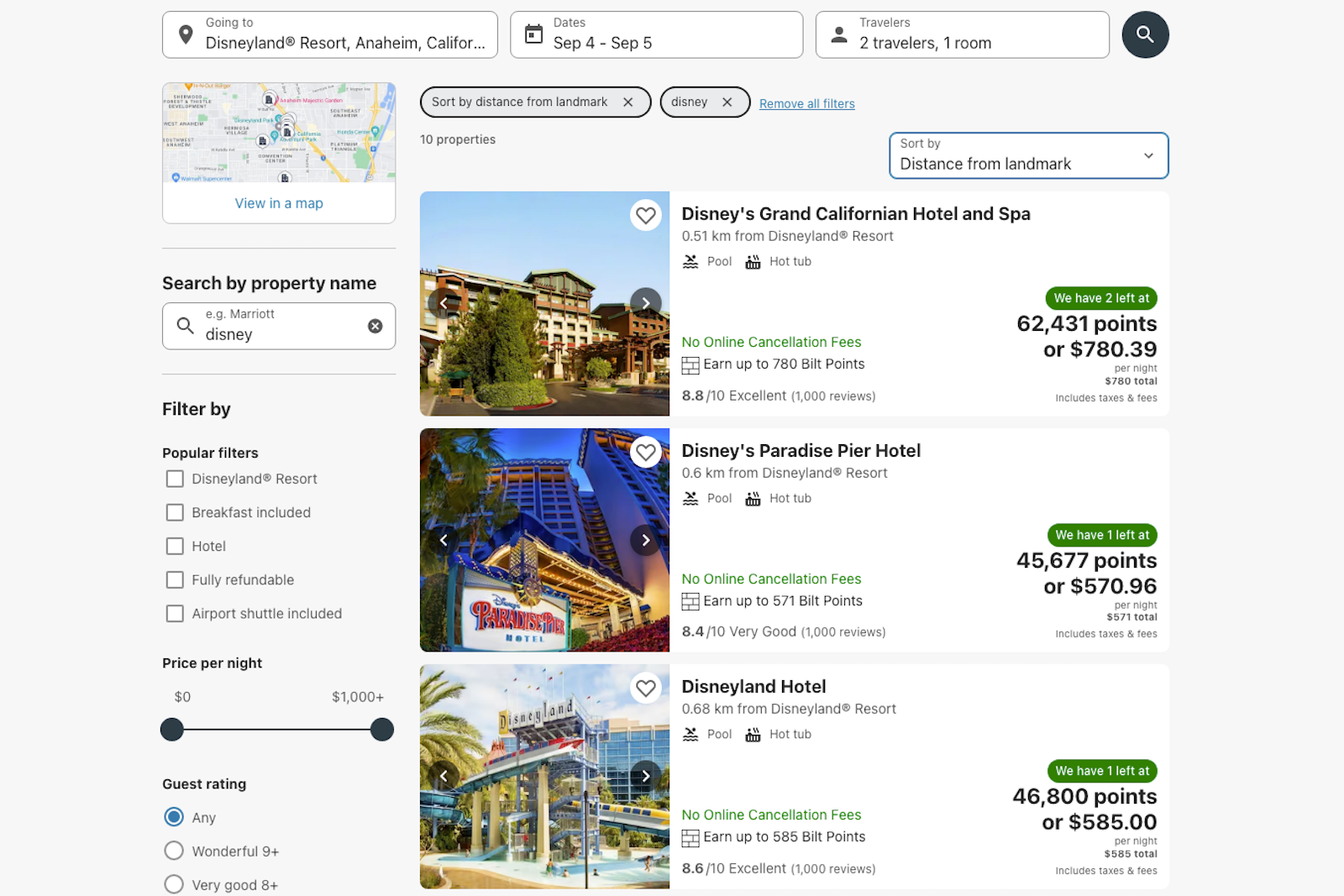

Bilt Rewards points can be redeemed at a rate of 1.25 cents per point toward some Disney hotels in the Bilt travel portal. See here for details on rewards and benefits of the Bilt Mastercard®. Until recently, Bilt had Disney World hotels in its travel portal, though it only has Disneyland and Disneyland Paris options. It’s worth checking to see if Disney World returns.

BILTREWARDS.COM

Additionally, you can use other points at a rate of 1 cent apiece for Disney hotels in various travel portals.

This includes the Citi Travel portal — with not only the Citi Strata Premier Card but also no-annual-fee options like Citi Double Cash® Card (see rates and fees) and Citi Rewards+® Card (see rates and fees) — and Capital One Travel, using miles at 1 cent apiece from cards like the Venture X, Capital One Venture Rewards Credit Card and Capital One VentureOne Rewards Credit Card.

Best cards for Disney tickets

There are multiple ways to earn bonus points on your Disney ticket purchase, but how you buy those tickets matters.

If buying tickets directly, the purchase should code as entertainment. Consider the Capital One Savor Cash Rewards Credit Card, which has no annual fee and earns 3% back on entertainment purchases (see rates and fees).

If you don’t have these cards, consider the best credit cards for everyday spending. These can provide a good return on spending, even without a bonus for entertainment or theme parks.

*Value of rewards is based on TPG’s October 2024 valuations and is not provided by the issuer.

But what if you don’t buy your Disney theme park tickets with your credit card? What if you buy them with a gift card instead?

Many office supply stores, warehouse clubs (such as Sam’s Club or Costco), Target, grocery stores and even home improvement stores sell Disney gift cards. These may or may not be on sale, but there are ways to make these purchases rewarding beyond just sales.

With the Ink Business Cash® Credit Card, you’ll get 5% back on the first $25,000 spent at office supply stores and on internet services, cable services and phone services each cardmember year (then 1% back). You can turn those earnings into Chase Ultimate Rewards points if you have a card that earns those points.

Using the American Express® Gold Card, you’ll earn 4 points per dollar on your first $25,000 in annual spending at U.S. supermarkets each calendar year (then 1 point per dollar). That’s an 8% return on spending, per TPG’s October 2024 valuations.

With either method, you’ll earn extra points or cash back when buying Disney gift cards; you can use the gift cards to pay for park tickets.

Best cards for Disney meals

Luckily, meals at on-property true restaurants typically code as dining, triggering the restaurants/dining category on credit cards that have it.

If you use a card with a travel bonus, thinking that would apply at a theme park, you won’t earn extra points. Instead, use a card that earns bonus rewards on dining purchases. Our favorite is the Amex Gold, since it earns 4 points per dollar spent on restaurants (up to $50,000 in spending per calendar year, then 1 point), so it’s a good choice for Disney restaurants.

Related: The best credit cards for dining and restaurants

How to choose the best credit card for your Disney vacation

When choosing the best card for Disney, there isn’t a cut-and-dry answer.

It’s worth pointing out that the right credit card for your Disney trip could change during your trip, as it depends on what you’re paying for and where you are paying.

More precisely, it depends on how that transaction codes on your credit card. The most likely bonus categories for theme park tickets are entertainment and travel.

However, there are additional costs that these cards might not cover. Consider your transportation to Anaheim, California or Orlando. You may need flights, gas or a rental car, and you may not have enough Rewards Dollars to cover your lodging, meals and tickets.

Where you buy Disney tickets matters

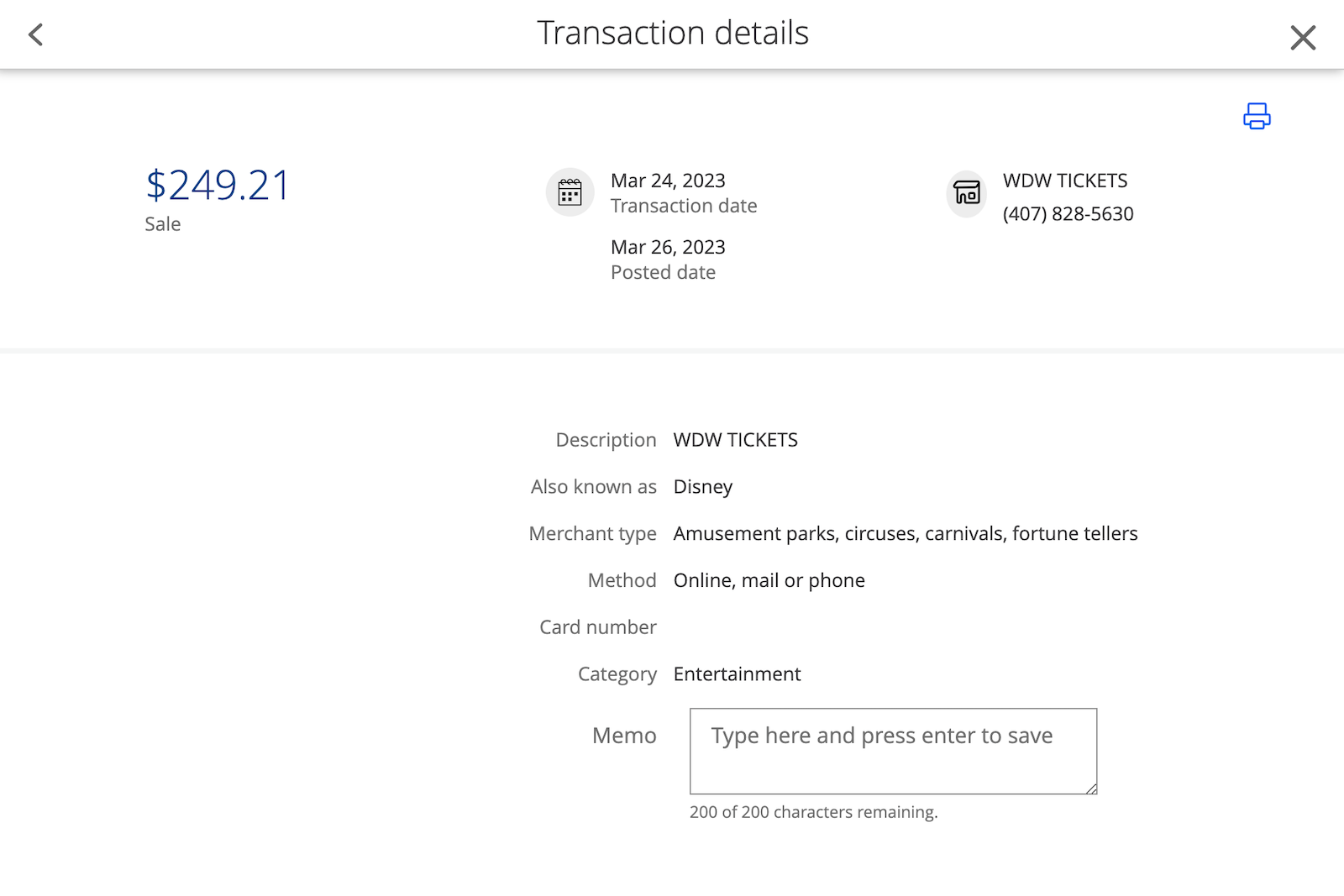

When purchasing park tickets directly from the theme park or Disney World annual passes, the charge should be coded as an entertainment purchase. On some credit cards, entertainment will code as a travel charge, though that’s not typical.

This purchase of Disney tickets is coded as entertainment.

However, if you purchase park tickets from a travel agency (such as Undercover Tourist), charge them to your hotel room or include them as part of a larger vacation package, the odds are high that the purchase will code as a travel charge.

Why does this matter? If you pay with the Chase Sapphire Reserve and your $500 ticket purchase codes as travel, you’ll earn 1,500 Ultimate Rewards points (3 points per dollar on travel). If the purchase codes as entertainment, you’ll earn just 500 points (since the card doesn’t have a bonus category for entertainment).

The way the card codes matters if you want to use some of its annual $300 travel credit toward your purchase.

Conversely, a reduce-the-wait Lightning Lane purchase codes as entertainment, so you should use your best credit card for entertainment expenses for that purchase.

Do you want to use your credit card’s travel credit at Disney?

If you want to use the annual $300 Chase Sapphire Reserve travel credit on a Walt Disney World or Disneyland trip, book a hotel or hotel-and-tickets package directly with Disney or via a travel agent, such as TPG’s partner Mouse Counselors.

If all you want is Disney theme park tickets, you can use your travel credit on purchases from a travel site like Undercover Tourist instead of purchasing directly from Disney. In this way, your purchase should code as travel, triggering your Sapphire Reserve’s travel credit.

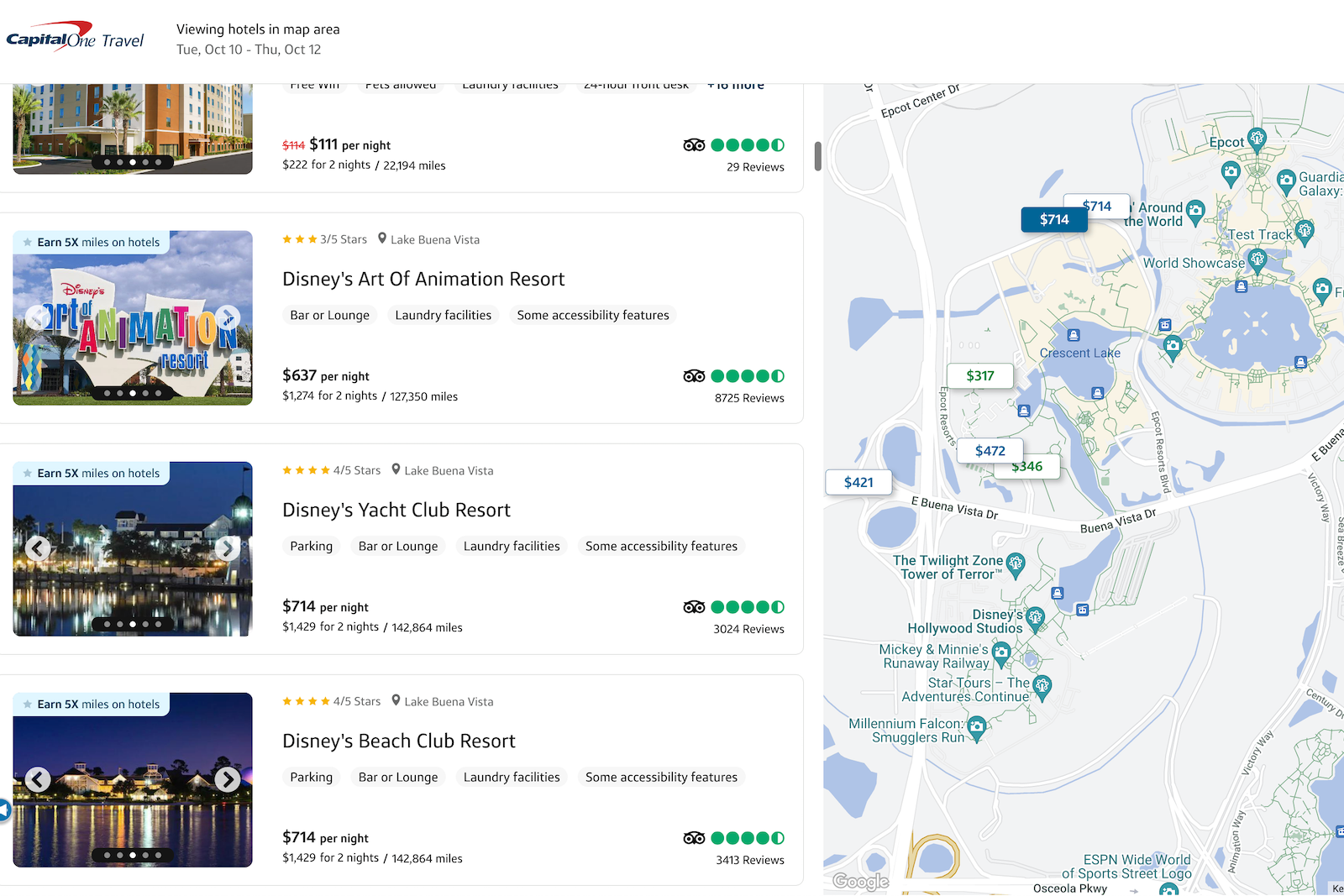

The Capital One Venture X Rewards also offers a $300 annual credit, but you need to book via Capital One Travel to use this perk. Luckily, this site often includes Disney World hotels in its booking options.

Two Citi credit cards also have credits that can knock down the costs of your next Disney trip: the Citi Prestige (no longer open to new applicants) and the Citi Strata Premier. Citi Strata Premier cardholders receive a once-per-year $100 credit for hotel bookings of $500 or more, excluding taxes and fees, booked on CitiTravel.com.

Citi Prestige cardholders can use their fourth-night-free perk twice a year to book hotels in Citi’s travel portal. Luckily, most Disneyland and Walt Disney World hotels appear in this portal.

Lastly, those with the Amex Platinum can use up to $200 in hotel statement credits annually for bookings with Fine Hotels + Resorts and The Hotel Collection (The Hotel Collection requires a two-night minimum stay). Select Disney properties near Disney World and Disneyland qualify, such as the JW Marriott Orlando Bonnet Creek, Four Seasons Resort Orlando at Disney World and the Westin Anaheim Resort. Enrollment is required; terms apply.

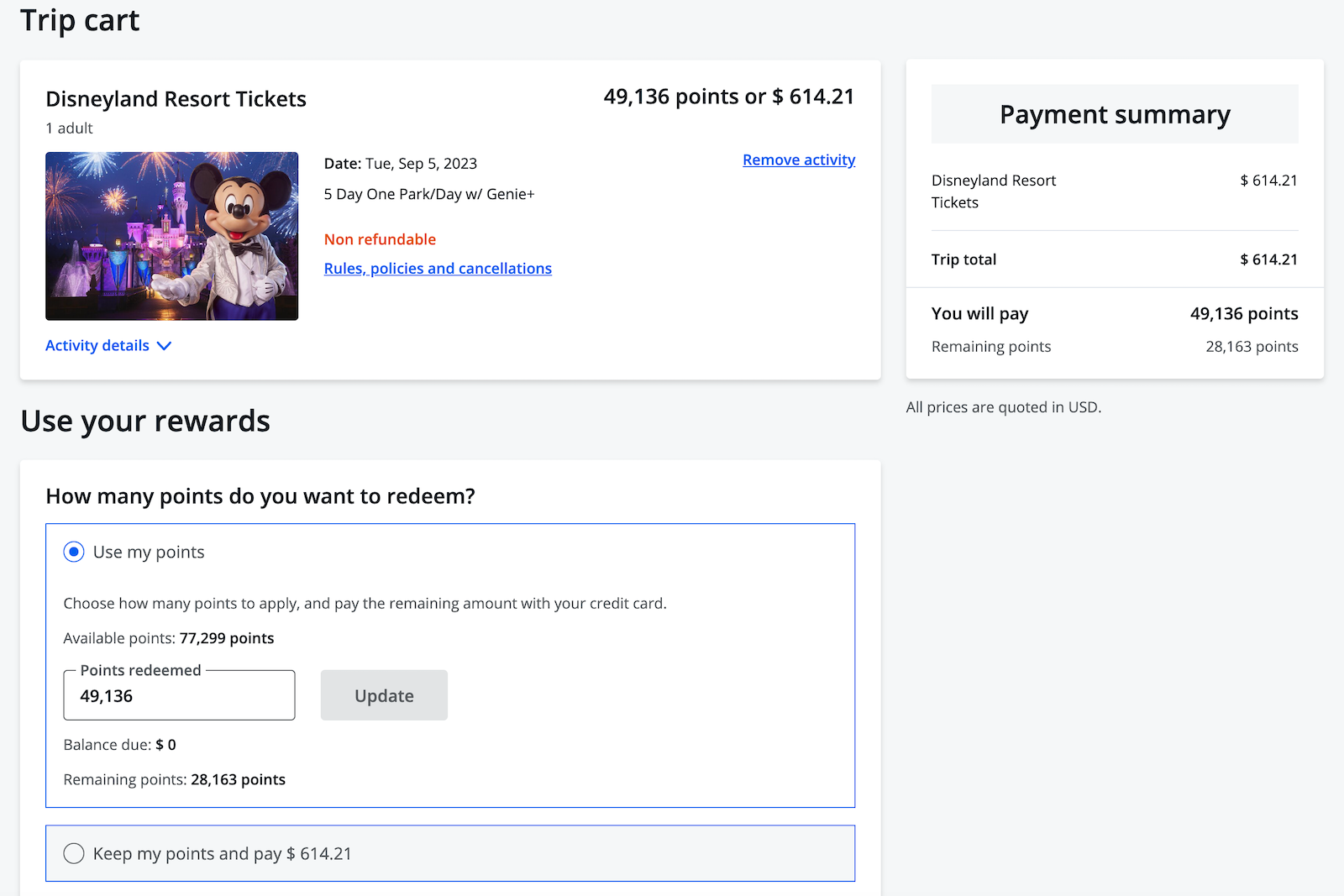

Do you want to redeem points on Disney tickets?

Let’s start with the bad news: Not all credit card points work for a trip to Disney.

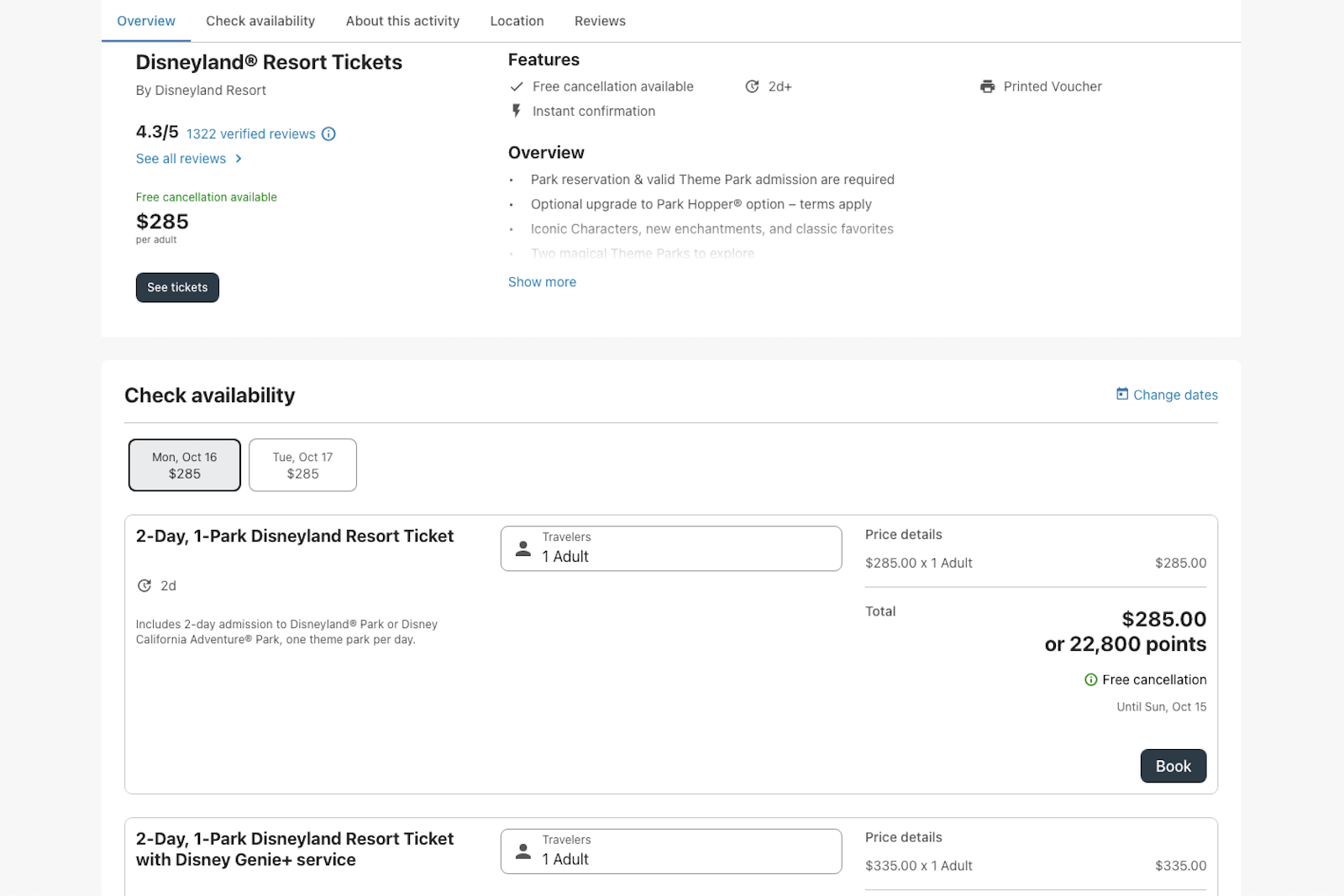

American Express Membership Rewards points aren’t very useful for Disney tickets. However, Bilt Rewards Points, Capital One miles, Chase Ultimate Rewards points and Citi ThankYou points are very handy — though in different ways.

With Bilt Rewards, you can book Disney tickets in its portal in the “Activities” section.

With Capital One Travel, you can book Disney hotels and pay with miles at a rate of 1 cent apiece. TPG senior writer Tarah Chieffi was able to use the Capital One miles she earned with her Capital One Venture X to cover three nights at Disney’s Yacht Club Resort.

However, since you can use your miles to offset any travel charge on your card, you can also book directly with Disney or elsewhere (as long as it codes as travel) and use points at a rate of 1 cent per mile to reimburse yourself. The same applies to reimbursing yourself for travel purchases with Bank of America rewards points.

If you have Chase Ultimate Rewards points, you can redeem these for Disneyland tickets but not Disney World tickets. The value of your points will vary from 1 to 1.5 cents apiece, depending on which card you have (with the Sapphire Reserve fetching the best value).

You can also rent Disney Vacation Club points from a site like David’s Vacation Club to save money on your Disney lodging and use credit card points to offset the expense. Additionally, most programs allow you to redeem points for a statement credit to reimburse yourself for purchases where you couldn’t pay with points.

Obviously, Disney credit cards play a role here, as well.

With the Disney Premier Visa Card, you’ll earn 2% back in Disney Rewards Dollars at Disney locations in the U.S.

You can redeem your Rewards Dollars for park tickets, resort stays and at stores and restaurants on Disney properties. Redeeming your rewards to offset flights purchased with your Disney Premier Visa is also possible. The card has a $49 annual fee.

Can you use your Disney credit card anywhere?

Disney credit cards can be used anywhere major credit cards are accepted, including Disney.

Building your own Disney credit card strategy

Disney Rewards Dollars can play an important role in offsetting costs for your magical holiday. However, sign-up bonuses from credit cards represent the fastest way to earn large sums of points and miles — the types that can be used to travel to Disney parks in ways Rewards Dollars can’t.

If you have the time and want the best of all worlds, it may make sense to earn a couple of different types of credit card rewards to use toward your Disney trip.

Using these questions as guidance, you can find the best credit card for a Disney trip that your family will love and your bank account will tolerate:

- What travel expenses do you have in addition to theme park tickets? The more varied your expenses for a Disney trip, the more transferable points will help you.

- Are you willing to stay off-property? If staying at a Disney-owned and -operated hotel is mandatory, your strategy will change. You can pay for your hotel with points if it’s not a requirement.

- What expenses can you pay for with points upfront?

- What expenses can you pay for and then offset with points afterward?

Related: A magical guide for how to plan a trip to Disney World this year

Bottom line

Options abound for using credit card points and miles to pay for various elements of your Disney trip. That’s good news, considering how expensive these vacations can be.

If you want to make a big dent in the cost of your trip, you may not be looking for the best Disney credit card but rather the best credit card for Disney. A combination of points, free nights and discounts from the above strategies can help defray costs when planning your family’s next trip to Disneyland or Walt Disney World, making it all feel extra magical.

Related:

For Bilt Mastercard rates and fees, click here.

For Bilt Mastercard rewards and benefits, click here.